Abu Dhabi, UAE – Achieving the global target set at COP28 to triple renewable power capacity by 2030 relies heavily on establishing conducive conditions for such growth. Tripling renewable power capacity by 2030 is technically feasible and economically viable, but its delivery requires determination, policy support and investment at-scale.

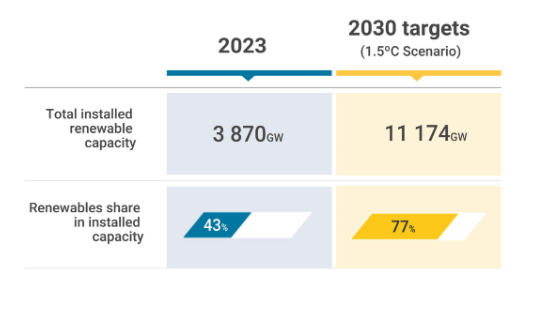

Tracking COP28 outcomes: Tripling renewable power capacity by 2030 highlights that 2023 has set a new record in renewable deployment, adding 473 gigawatts (GW) to the global energy mix. However, the brief by the International Renewable Energy Agency (IRENA) concludes that tripling renewable power capacity depends on overcoming systemic and structural barriers to the energy transition.

Evolving policies, geopolitical shifts and declining costs have all played a role in propelling the rapid expansion of renewable energy in markets worldwide. Yet, to triple renewable power capacity, concerted efforts are required to enhance infrastructure, policies and workforce capabilities, underpinned by increased financing and closer international cooperation, as outlined in IRENA’s World Energy Transitions Outlook brief presented at the Berlin Energy Transitions Dialogue today.

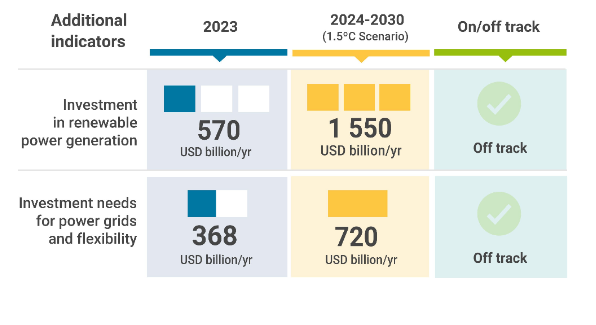

An average of almost 1,100 GW of renewables capacity must be installed annually by 2030 – more than double the record set in 2023. Annual investments in renewable power generation must surge from USD 570 billion in 2023 to USD 1550 billion on average between 2024 and 2030.

Francesco La Camera, Director-General of IRENA, said: “In the wake of the historic UAE Consensus on tripling renewables at COP28, these capacity additions—despite setting a new record—clearly indicate that achieving the target is far from guaranteed. As the custodian agency, IRENA monitors related progress across key indicators every year. Our data confirms that progress continues to fall short, and the energy transition remains off track. We urgently need a systemic shift away from fossil fuels to course-correct and keep the tripling goal within reach.”

Achieving the tripling target is far from assured as an additional 7.2 terawatts (TW) of renewable power would need to be deployed to reach the required 11 TW by 2030. However, current projections indicate the target will remain out of reach without urgent policy intervention. G20 nations, for example, must grow their renewable capacity from under 3 TW in 2022 to 9.4 TW by 2030, accounting for over 80% of the global total.

Accelerated investments in infrastructure and system operations (e.g. power grids, storage), revised policies and regulations (e.g. power market design and streamlined permitting), measures to fortify supply chains and cultivate requisite skills, and substantial increases in investments—including public funds facilitated through international collaboration—are imperative.

Despite considerable renewable potential, developing countries have received disproportionately low levels of investment. Although energy transition-related investments have reached a record high, exceeding USD 2 trillion in 2023, emerging markets and developing economies accounted for just over half of global investments. One hundred and twenty developing nations attracted only 15% of global renewable investment, with Sub-Saharan Africa receiving less than 1.5%, despite being home to the highest share of energy-deprived populations.

In contrast, fossil fuels received USD 1.3 trillion in subsidies in 2022, equivalent to the annual investment required in renewable generation capacity to achieve a threefold increase by 2030. A key aspect of IRENA’s 1.5°C Scenario is that the increase in renewable energy use must be coupled with a corresponding decline in fossil fuel reliance. Both aspects are lagging. G20 members alone disbursed a record USD 1.4 trillion in public funds to bolster fossil fuels in 2022, directly contradicting the commitment made at COP28 to transition away from fossil fuels.

Greater international cooperation will be indispensable to ensure financial flows to the Global South and uphold the tripling pledge. Countries in Sub-Saharan Africa face some of the world’s highest finance costs, underscoring the need for enhanced international collaboration, including the involvement of multilateral development banks and an expanded role for public finance.

Strategic use of public finance is paramount to attract investment at scale and deliver an inclusive energy transition that yields socioeconomic benefits for all. This requires structural reforms, including within multilateral finance mechanisms, to effectively support the energy transition in developing countries