NEEDHAM, Mass – Worldwide smartphone shipments declined 8.7% year over year in the second quarter of 2022 (2Q22).

According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, this marks the fourth consecutive quarter of decline for the smartphone market as shipments fell to 286.0 million units in the quarter, about 3.5% lower than forecast.

“What started out as a supply-constrained industry earlier this year has turned into a demand-constrained market,” said Nabila Popal research director with IDC’s Worldwide Tracker team.

“While supply improved as capacity and production were ramped up, roaring inflation and economic uncertainty have seriously dampened consumer spending and increased inventory across all regions. OEMs have cut back orders for the rest of the year with Chinese vendors making the biggest cuts as their largest market continues to struggle.”

Although researchers expect demand to start picking up in some regions towards the end of the year, the outlook for the 2022 smartphone market will definitely be revised down a few points. We continue to believe that any reduction today does not demand that is lost, but simply pushed forward, she added.

From a regional standpoint, the largest second quarter decline was in Central and Eastern Europe (CEE), as expected, with a 36.5% year-over-year drop as the war in Ukraine continues to hamper the region.

However, from a volume standpoint, CEE only accounts for 6% of global shipments, so the biggest drawdown on global volumes came from China, which declined 14.3% year over year. Asia/Pacific (excluding Japan and China) (APeJC), which accounts for nearly half of all shipments worldwide, also declined 2.2% in 2Q22. All other regions, except Canada, saw low-to-mid single-digit declines.

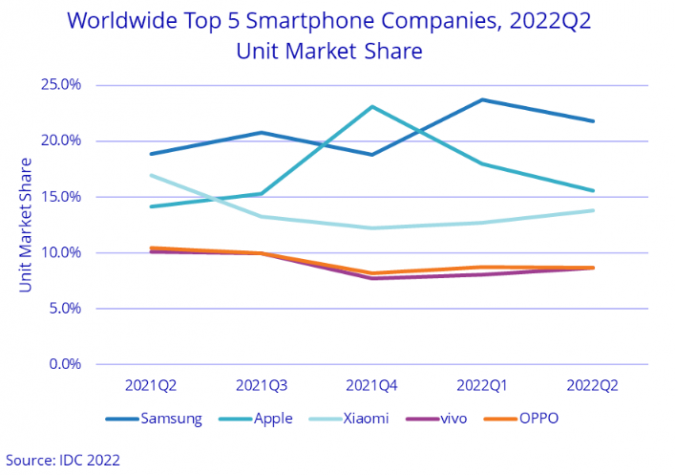

Despite the challenging environment, vendor positioning was not altered much during 2Q22. Samsung held the top spot with 21.8% share and healthy growth in all regions except Europe. Data shows that Apple came in second with 15.6% share, while Xiaomi came in third narrowing the gap to 13.8% share. vivo and OPPO ended the quarter tied for the fourth position with 8.7% and 8.6% share respectively.